ENDOWED INVESTMENT

POOL ASSET MIX

POOL ASSET MIX

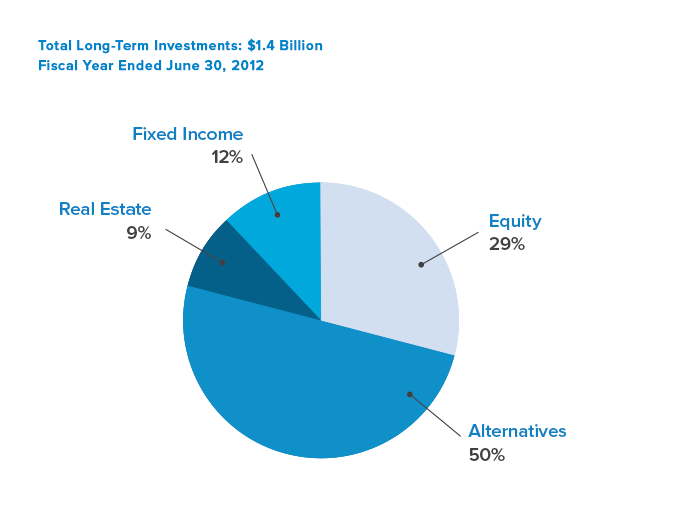

On June 30, 2012, the balance in The Foundation’s endowed investment pool was $1.4 billion. The pool is diversified by asset class, sector and geography, and has been constructed to achieve a return objective sufficient to cover 5% annual payout, inflation and costs over the long term.

For the fiscal year ended June 30, 2012, The Foundation’s endowed pool generated a negative investment return of 1.5% primarily as a result of exposure to international equities and commodities, both of which experienced negative returns for the period.